ELSS vs NPS vs PPF

Publication details: Zee Business

Responses, opinion and view from Kartik Jhaveri

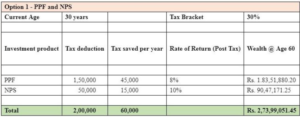

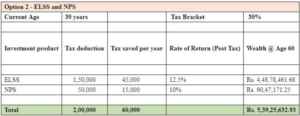

ELSS and NPS are mainly known as a retirement-oriented savings vehicle options and ultimately serve the same purpose. But, the ground zero reality is different. Most of the investment experts say that for an investor who wants flexibility in investment Public Provident Fund (PPF) with ELSS offerings is a better option but for those who are investing only for their retirement, National Pension Scheme (NPS) is better as it yields around 10 percent post-tax return. Ironically, investors opt for such products to save tax. Both the options are eligible for Tax deduction under section 80C of the Income Tax Act (ITA). Under section 80C, the maximum investment allowed in PPF is Rs 1.50 Lakh per annum. Additionally, an investor can invest in NPS under sec 80CCD (1B) up to a maximum of Rs 50,000 per annum. However, if we compare it with the normal PPF instead of PPF with ELSS offerings, we found later one is better as it maximizes the return post-retirement or after 60 years of age.

Detailing the flexibility benefits in NPS against the PPF investment Kartik says, In PPF, an investor can’t invest beyond Rs 1.5 lakh while in NPS an investor can invest any amount though he or she can claim tax benefit up to Rs 50,000 in one financial year.” He said that in PPF, an investor has more flexibility as he or she can stop investment after 5 years and can withdraw the whole amount after 15 years while in NPS the whole amount is strictly fixed for a long period till the investor attains 60 years of age and the investor can’t fish out the amount in between.

Source: HappyFactory

Source: HappyFactory

Source: HappyFactory

Source: HappyFactory

Features of the ELSS, PPF and NPS

“PPF account matures after completion of 15 years. One may extend the term after 15 years by a block of another 5 years with or without making additional contributions. The maturity amount of PPF is 100 percent tax-free. PPF is a 100 percent Debt oriented product, guaranteed by the government, providing safety of capital. The current annual interest rate on PPF is 8 percent.”