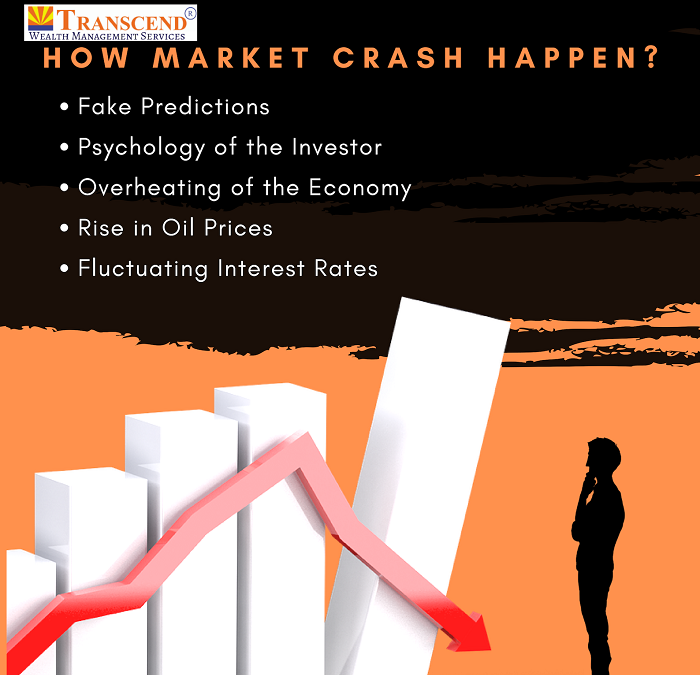

1. Fake Predictions:

a. When market falls, people start predicting falsely about the sectors, eg. Banks will sink, Companies becoming bankrupt, etc. On recovery of the market scenario, people start predicting

exactly the opposite.

2. Psychology of the Investor:

a. Generally, investors buy when the market is high and sell when the market falls, this psychology of the investors hampers the economy.

3. Overheating of the Economy – It happens due to the following factors:

a. Inflation is growing,

b. Market speculations are high and also the greediness of the people rises,

c. There is strong uncertainty in direction of the US Economy.

4. Rise in Oil Prices:

a. Rise in global prices pushes up the demand of dollars and also raises inflation.

b. This leads to depreciation in the value of rupee, which ultimately affects the economy.

5. Fluctuating Interest Rates:

a. There is rise in interest rates due to growing Inflation. This rise would affect the economy driving down the value of stocks.